In today’s rapidly evolving world, renewable energy sources are becoming increasingly crucial in our fight against climate change. From solar panels to wind turbines, this article delves into the advancements and challenges faced by the renewable energy sector. We’ll explore the latest technologies, government policies, and how individuals can contribute to a more sustainable future.

Category: Uncategorized

Investor Focus Will Return to the BTC-Spot ETF-Market and Flow Data

On Sunday, BTC rose by 0.31%. Following a 1.53% on Saturday, BTC ended the session at $51,697. BTC ended the week down 0.92% despite gains over the weekend.

There was no BTC-spot ETF market flow-related data for investors to consider. However, investors remained optimistic about the outlook for BTC-spot ETFs and the evolution of the crypto-spot ETF market.

Experts Trade Bitcoin with IC Markets

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spread

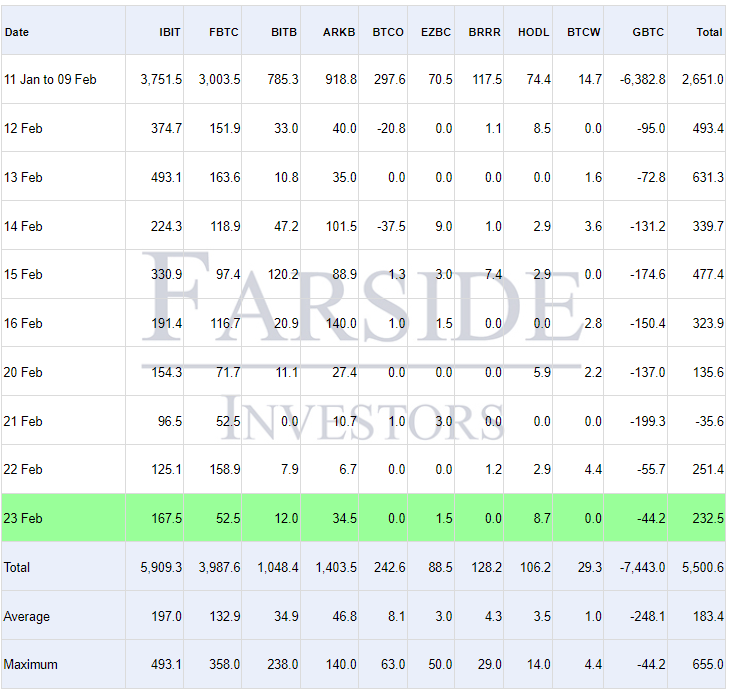

Downward trends in Grayscale Bitcoin Trust (GBTC) outflows resonated over the weekend. According to Farside Investors, GBTC recorded $44 million in net outflows on Friday, the lowest since January 11.

However, BTC-spot ETF market flow data for Monday, February 26, must improve to drive buyer demand for BTC. Flow data for iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) remain the focal points. Nonetheless, ARK 21Shares Bitcoin ETF (ARKB) and Bitwise Bitcoin ETF (BITB) must contribute to the BTC-spot ETF market for net inflows to return to $2 billion.

Beyond the crypto market, sentiment toward the timeline for a Fed rate cut may influence BTC-spot ETF market flows.

Fed Rate Cut Timelines and US Inflation May Influence BTC-Spot ETF Market Trends

Probabilities of the Fed cutting interest rates in March and May declined last week.

According to the CME FedWatch Tool, the probability of a 25-basis point Fed rate cut fell from 10.0% to 2.3% in the week ending February 23. Significantly, the chances of a 25-basis point May rate cut declined from 28.0% to 19.4% over the same period. The probability of a 50-basis point May rate cut declined from 2.3% to 0.6%.

From Tuesday (Feb 20) to Friday (Feb 23), the BTC-spot ETF market saw total net inflows of $573.5 million, down from $1,778 million of net inflows from Tuesday to Friday in the previous week.

US economic indicators could further influence BTC-spot ETF market flow trends this week. US Core Price Index numbers (Thurs) will likely impact the timeline of a Fed rate cut and the appetite for riskier assets.

ETH Outmuscles BTC in February

In contrast to the BTC pullback, ETH continued to rally on bets the SEC will approve the first batch of ETH-spot ETFs in May. ETH ended the Sunday session up 3.99% to $3,113. Significantly, ETH held onto the $3,100 handle for the first time since April 10, 2022.

While BTC has gained 20.71% in February, ETH is up 36% in February.

On Thursday, February 22, Coinbase (COIN) sent a letter to the SEC arguing for an ETH-spot ETF market. Coinbase responded to the SEC’s request for public comment on the Grayscale Ether Trust.

Further issuer and SEC activity needs consideration on Monday.

Technical Analysis

Bitcoin Analysis

BTC remained well above the 50-day and 200-day EMAs, sending bullish price signals.

A BTC break above the $52,500 handle would support a move to the $53,000 resistance level and the Tuesday high of $53,026.

BTC-spot ETF market flow data needs consideration.

However, a break below the $50,500 support level would give the bears a run at the $48,178 support level.

The 14-Daily RSI reading, 66.47, suggests a BTC move to the $53,000 resistance level before entering overbought territory.

BTCUSD 260224 Daily Chart

Ethereum Analysis

ETH sat well above the 50-day and 200-day EMAs, affirming bullish price signals.

An ETH break above the Monday morning high of $3,132 would bring the $3,200 resistance level into play.

ETH-spot ETF-related activity needs investor attention.

However, an ETH drop below the $3,100 handle would bring the $2,770 support level into view.

The 14-period Daily RSI at 77.13 shows ETH in overbought territory. Selling pressure may intensify at the Monday morning high of $3,132.